What are balance sheet accounts?

Content

No investor is likely to put Using Balance Sheets In Accounting into a business unless they look at a balance sheet first. Along with an income statement, an earnings report, and a statement of cash flow, an investor has everything they need to determine the state of a company’s finances.

- While commercialaccounting softwaresuch as Quicken is fine, it’s a good idea to go to aprofessional accountantthe first time you set a balance sheet up.

- However, at the same time, the liabilities section also incurs an increase of $10,000 as the long-term debt account is equally affected by the transaction.

- A balance sheet analysis helps you get a sense of your current standing, and the first step is to look at your balance sheets from two or more accounting periods.

- If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity.

- Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

They are categorized into two, current and long-term liabilities. Long-term liabilities refer to long-term debts and nondebt financial obligations due after a period of more than one year. This segment of the balance sheet includes return of equity , calculated by dividing net income by shareholder’s equity. ROE measures management’s effectiveness in employing and driving returns based on equity. These can include company owners for small businesses or company bookkeepers.

Major balance sheet equation

If the numbers don’t look good, it can prompt an internal shift in how you conduct the business. Remember —the left side of your balance sheet must equal the right side (liabilities + owners’ equity).

The most common shareholders’ equity accounts are noted below. You can list these formulas in your skills section to imply your knowledge of balance sheets, or you can list “financial statements” as a skill on its own. Additionally, you can use the description section for prior work or internship experience to talk about times when you created or used financial statements in a professional setting. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet.

Step 4: Determine current liabilities

Now that we have seen some sample balance sheets, we will describe each section of the balance sheet in detail. If this is not the case, a balance sheet is considered to be unbalanced, and should not be issued until the underlying accounting recordation error causing the imbalance has been located and corrected. This line item contains the amount paid by the business to acquire shares back from investors.

Does Juniper Networks (NYSE:JNPR) Have A Healthy Balance Sheet? – Simply Wall St

Does Juniper Networks (NYSE:JNPR) Have A Healthy Balance Sheet?.

Posted: Fri, 17 Feb 2023 17:16:41 GMT [source]

The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, hence the name. If they don’t balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations. Shareholders’ equity is sometimes called capital or net worth. It’s the money that would be left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the shareholders, or the owners, of the company.

What might you need beyond balance sheets?

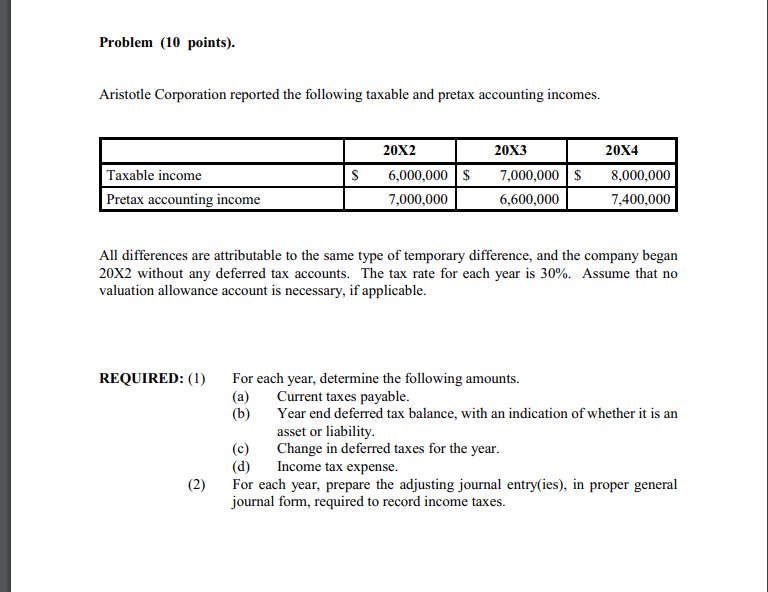

You’ll need to calculate all liabilities to complete balance sheet accounting equations, practice good bookkeeping and complete or calculate other financial ratios using programs like Excel or others. A balance sheet is a detailed financial statement that breaks down all of a company’s assets, liabilities, and equity at a specific time, such as the end of a month, the end of a quarter or the end of a year. Shareholders equity is the initial amount of money invested in a business. Where retained earnings are transferred from the income statement, into the balance sheet, they form the company’s net worth. Drew Gerber started three businesses of his own, and now runs a Georgia firm that helps small businesses market themselves.

What is the main purpose of a balance sheet?

A balance sheet is a financial document of the assets, liabilities, and equity of a business at the end of an accounting period. Business owners and investors use them on a regular basis to gauge the general financial health of their organizations.

Besides timing, this figure reconciles differences between requirements for financial reporting and the way tax is assessed, such as depreciation calculations. Fixed assets include land, machinery, equipment, buildings, and other durable, generally capital-intensive assets. Accounts receivable refer to money that customers owe the company. This may include an allowance for doubtful accounts as some customers may not pay what they owe. Accounts payable, also called trade payables, are amounts that a business owes its vendors for purchases of goods and services. Inventory cost is based on specific identification or estimated using the first-in, first-out or weighted average cost methods.

Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company . Notes payable may also have a long-term version, which includes notes with a maturity of more than one year.

If a https://personal-accounting.org/ buys a piece of machinery, the cash flow statement would reflect this activity as a cash outflow from investing activities because it used cash. If the company decided to sell off some investments from an investment portfolio, the proceeds from the sales would show up as a cash inflow from investing activities because it provided cash. Cash flow statements report a company’s inflows and outflows of cash. This is important because a company needs to have enough cash on hand to pay its expenses and purchase assets. While an income statement can tell you whether a company made a profit, a cash flow statement can tell you whether the company generated cash. Assets are generally listed based on how quickly they will be converted into cash.