Accounting for Nonprofit Organizations Financial Statements & Beyond

Content

Eric is a Consulting partner with more than 20 years of experience serving nonprofit and for-profit organizations. For more than 60 years, we have been committed to supporting finance teams across the country. We work with more than 650 nonprofits and private education organizations. Powerful and 100% free accounting software that has everything you need to confidently run your own business. Manage accounts payable, categorize expenses, and find out where most of your church’s money is going. Automatically import your transactions into your bookkeeping software with easy and unlimited bank account and credit card connections.

Budget for a single year or multiple years to make sure your grant-funded programs are financially healthy and on track. The experts at Profit Matters are well-versed with a number of valuable accounting technology tools, meaning they can adapt to the system your organization is already using. They have experience with tools like QuickBooks, Sage 50cloud, Xero, NetSuite, Zoho Books, and FreshBooks. The Jitasa team ensures that every organization it works with has all of the tools it needs to effectively record financial transactions and take appropriate action with its mission in mind. Tax information is recorded correctly for you to maintain your organization’s tax-exempt status. A primary point of contact at Jitasa will lead the engagement with your nonprofit, but you’ll always have access to a full team of accountants.

Award-Winning Software and Customer Service

These restrictions mean that you have to ensure their funds are spent in a way that the supporters approve of. That’s why nonprofits employ a type of accounting known as fund accounting. Good nonprofit financial management should ensure that the organization can function and grow. However, if your functional expenses become too large, donors might hesitate to give. Nonprofit organizations exist to nonprofit accounting further a mission or goal, and they rely on funding sources that include donations, grants and program revenue. Like for-profit businesses, nonprofit organizations are expected to document earnings and expenses for full financial transparency. Accounting can help nonprofit organizations function properly, thereby indirectly providing a wealth of opportunities to create change for people in need.

What are 2 disadvantages of a nonprofit organization?

- Limited Purposes. In order to be exempt under the tax laws, a nonprofit organization can only perform certain functions listed in those laws.

- Lobbying.

- Public Scrutiny.

It really helps to catch any mistakes and prevent inadvertent wrongdoing. While your board members are involved in the annual budget approval process, this shouldn’t be the only time during the year that you take a deep dive into your budget.

Work Toward a Career in Accounting for Nonprofit Organizations

Cash-basis accounting is a system where you record expenses or income when you actually pay or receive them, not when the transaction takes place. Using the cash-basis accounting system, you record payment when you actually receive dues from members. However, you cannot use this method if you make more than $5 million in annual gross sales or more than $1 million in gross receipts for inventory sales, or if you extend credit.

- A 12-month partnership to ensure your financial tools effectively tell your organization’s story.

- Understanding the flow of cash in and out of your nonprofit will help you and your accounting team plan and budget for regularly occurring financial trends.

- Log in anytime to get a big picture sense of your church’s financial position.

- In reviews of Araize, many people say the program is robust and powerful.

While a volunteer or staff member might be able to take on their organization’s bookkeeping duties, they’d be hard-pressed to take on an accountant’s responsibilities. Get all of the information you need to efficiently manage your nonprofit with our monthly newsletter. Some items are easily taken home from the office and forgotten about. Take regular inventory of the computers, cell phones, and other items that you allow your organization’s staff members to work with. These are the funds that must be spent on certain projects and activities at your organization.

Nonprofit Accounting & Bookkeeping Referrals

Nonprofits must also be careful to record and report the valuation of specific employee benefits, which can count as taxable income if not reported properly. “A nonprofit’s UBTI includes any qualified transportation fringe benefits and on-premises athletic facilities provided to employees,” said Treppa.

- You can have either positive or negative cash flow in your nonprofit.

- They keep their own team updated with the latest financial compliance standards and provide educational materials about such matters to their nonprofit clientele as well.

- When you reconcile your bank accounts, all you’re doing is comparing each transaction from your bank statement with the ones you have in your books.

- In this document, you’ll record your nonprofit’s revenue and expenses from the year, to demonstrate how finances have been utilized.

- In addition, checking in on the budget one or more times each month will allow you to adapt to change.

- So check with your tax/legal team to make sure you’re prepared for any potential tax bills.

Financial Edge is a cloud-based program, so you can use it from any laptop. You can use Financial Edge to create budgets, track expenses, manage cash flow, and handle the general ledger. It has expanded budgeting capabilities, so you can forecast different scenarios and budget across fiscal years. For large nonprofit organizations that have significant accounting needs as well as employees and a large donor-base, Financial Edge can be an excellent fit and it’s our top choice for large organizations. For large organizations that want enterprise-level accounting, Financial Edge is the clear choice. It integrates with Raiser’s Edge, a program of choice for donor and constituent management, and allows you to track expenses and budget across fiscal years.

Reference your budget frequently.

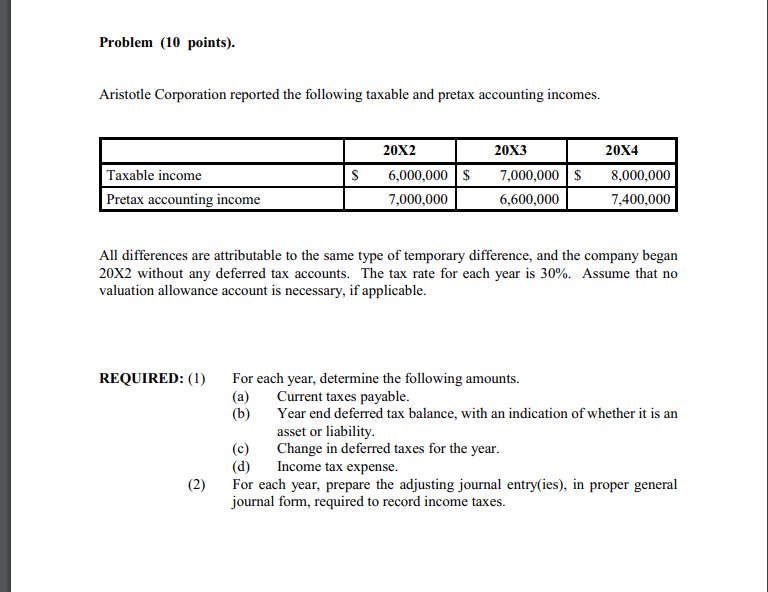

If your organization is larger, has hundreds of donors, or accepts a significant amount of online payments, you likely need a more robust program and will need to pay more money for accounting software. Large-scale organizations with thousands of donors will need enterprise-scaled solutions, such as QuickBooks Enterprise Nonprofit or Blackbaud’s Financial Edge. Nonprofit accounting is vastly different from for-profit accounting. Nonprofits are backed by donations and grants, so they have strict financial accounting standards they have to meet. In terms of reporting requirements, nonprofits have to meet FAS 116 and FAS 117 (Financial Statements of Not-for-Profit Organizations) standards.

Nonprofit Accounting Software Market to Set Phenomenal Growth … – Digital Journal

Nonprofit Accounting Software Market to Set Phenomenal Growth ….

Posted: Mon, 09 Jan 2023 08:00:00 GMT [source]

Your accountant or accounting staff should also monitor donations closely and record them in compliance with GAAP. You must record promises of future donations when you receive the pledge instead of when your nonprofit receives the actual donation. Generally accepted accounting principles are a set of accounting procedures and standards issued by the Financial Accounting Standards Board . All public companies in the U.S. must follow GAAP and private companies generally do as well. Nonprofits must also follow GAAP standards, although their rules are sometimes slightly different from the ones for-profit companies follow.

Nonprofit accounting vs. bookkeeping

Many nonprofit and for-profit organizations are now subject to the single audit due to COVID federal funding. Log in anytime to get a big picture sense of your church’s financial position. Wave displays instant invoicing, payroll, and payments data updates, along with dashboards for cash balances. AVAILABLE NOW – Great Beginnings for New Nonprofits, a free 8-part email course on fundraising, financial management and other “must know” topics. We’re here to help you with your nonprofit financial management journey. Araize offers two other programs you can purchase separately or bundle with the accounting program.

We recommend doing a bank reconciliation at least once a month to make sure your books are up to date and accurate, to help track cash flow, to prevent fraud and to detect bank errors. Don’t use your personal bank account to receive, hold or disburse money for your nonprofit. Make sure all of your nonprofit’s transactions go through a dedicated bank account. Ask your bank whether they offer business chequing accounts tailored to nonprofits.